- What Are Common Causes of .ATM Files Lost or Failure?

- How to recover lost .ATM files?

- Programs to recover .ATM files

- How to open file with .ATM extension?

What Are Common Causes of ".ATM" Files Lost or Failure?

There are several common causes for ".ATM" files lost or failure:

- Accidental deletion: Users may accidentally delete ".ATM" files while organizing or cleaning up their computer system, leading to their loss.

- Software or hardware malfunction: Issues with the software or hardware of the computer system can result in ".ATM" files becoming corrupted or inaccessible.

- Virus or malware attack: Malicious software can infect and damage ".ATM" files, making them unreadable or causing them to be deleted.

- Power failure: Unexpected power outages or system shutdowns can interrupt the saving or retrieval process of ".ATM" files, leading to their loss or corruption.

- File system errors: Issues with the file system, such as corruption or errors, can cause ".ATM" files to become lost or inaccessible.

- Improper file transfer: If ".ATM" files are not transferred correctly or interrupted during the process, they may become damaged or lost.

- Disk errors: Physical errors on the storage medium where ".ATM" files are stored, such as bad sectors or disk failure, can result in the loss or corruption of these files.

- Software conflicts: Incompatibility or conflicts between different software applications can cause ".ATM" files to become corrupted or fail to open properly.

- User error: Mistakes made by the user, such as improper handling of ".ATM" files or unintentionally overwriting them, can lead to their loss or failure.

- Aging or faulty storage media: Over time, storage devices like hard drives or flash drives can degrade or develop faults, leading to the loss or corruption of ".ATM" files.

How to recover lost ".ATM" files?

Sometimes while working with a computer, laptop or other stationary or mobile devices, you may encounter various bugs, freezes, hardware or software failures, even in spite of regular updates and junk cleaning. As a result, an important ".ATM" file may be deleted.

🧺 How to Recover Files and Folders After Sending Them to the Recycle Bin and Deleting? (Windows 11)

By no means should you think that the only way to recover a ".ATM" file is always to create it once more.

Use programs for recovering ".ATM" files if a file was lost after accidental or deliberate deleting, formatting the memory card or the internal storage, cleaning the storage device, after a virus attack or a system failure.

Programs to recover ".ATM" files

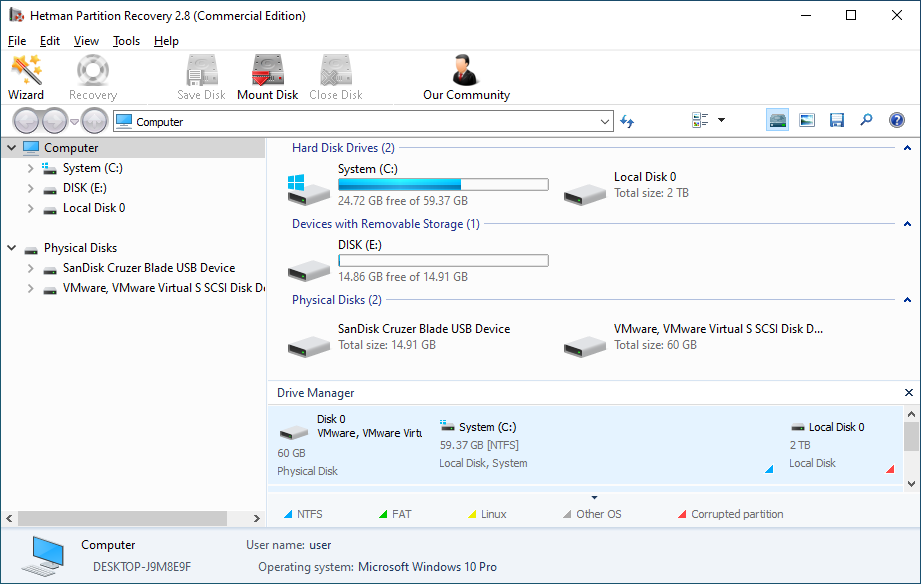

Looking for a way to get files back? In cases when files were deleted and they cannot be restored by using standard operating system tools, use Hetman Partition Recovery.

Follow the directions below:

-

Download Hetman Partition Recovery, install and start the program.

-

The program will automatically scan the computer and display all hard disks and removable drives connected to it, as well as physical and local disks.

-

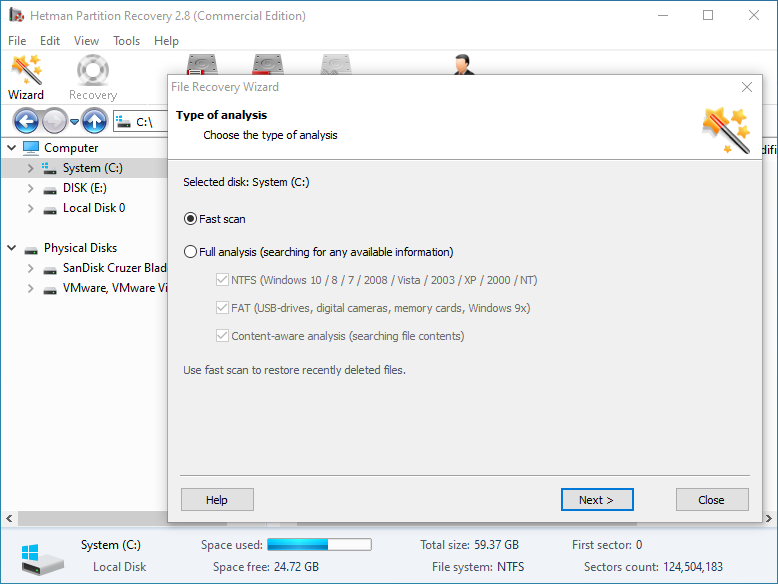

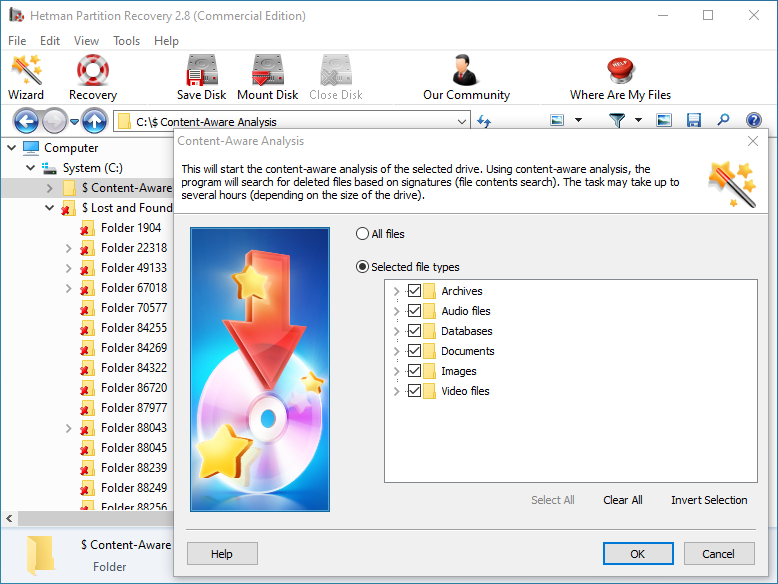

Double-click on the disk from which you need to recover ".ATM" files, and select analysis type.

-

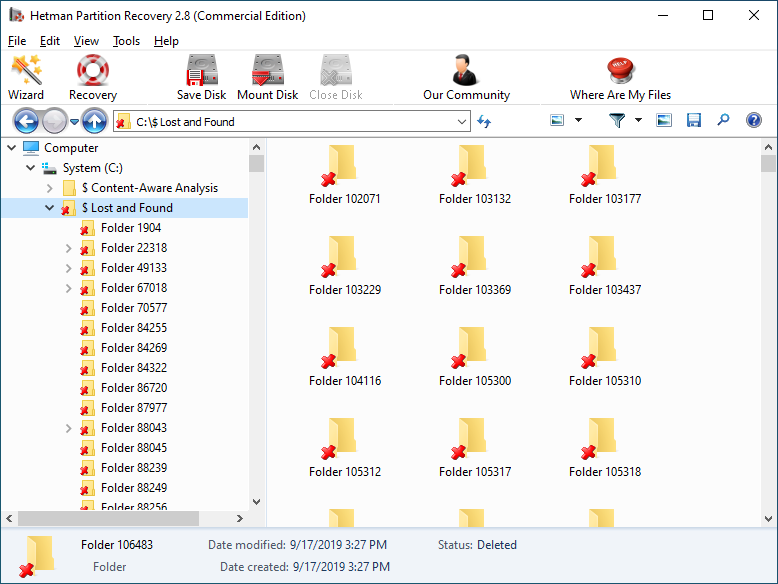

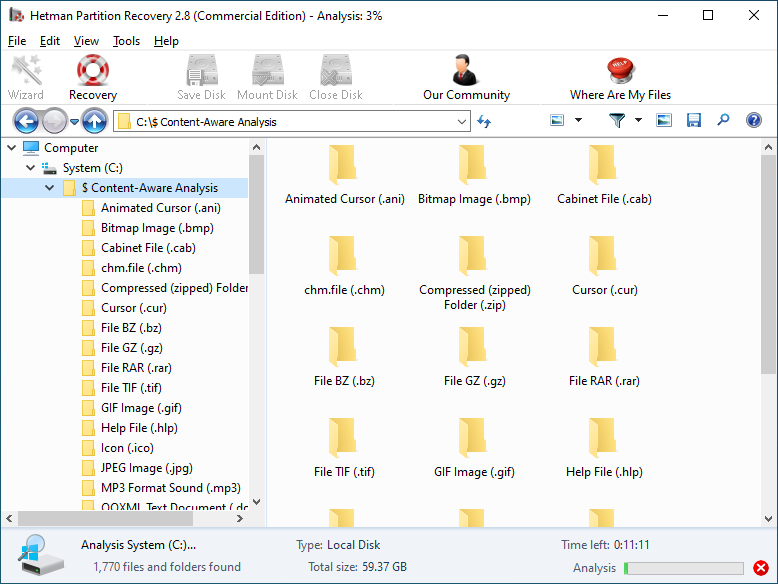

When the scanning is over, you will be shown the files for recovery.

-

To find a file you need, use the program’s interface to open the folder it was deleted from, or go to the folder "Content-Aware Analysis" and select the required file type.

-

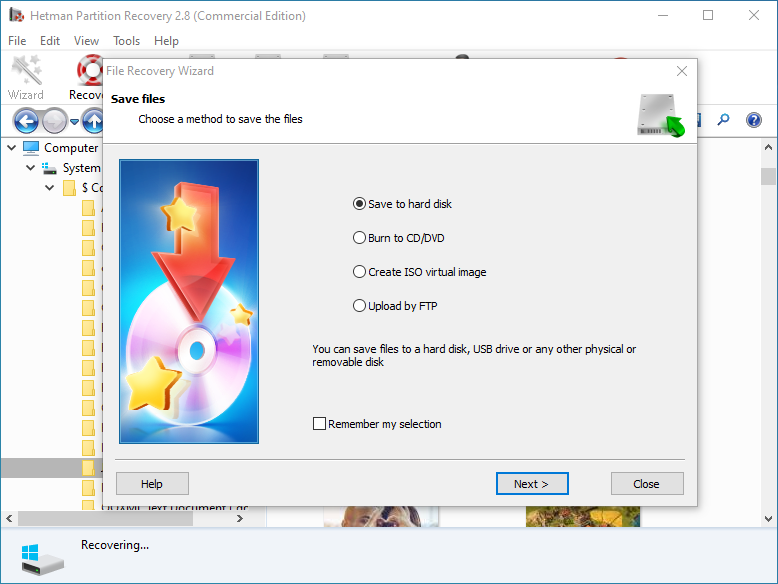

Select the files you have been looking for and click "Recovery".

-

Choose one of the methods for saving the files and recover them.

How to open file with ".ATM" extension?

Looking for how to open a stereo vue Atmospheres File image file file?

Programs that open ".ATM" files

| Windows |

|---|

|

|

| Mac |

|

|

Additional Information

-

File type: Vue Atmospheres File

-

File extension: .ATM

-

Developer: E-on Software

-

Category: 3D Image Files

-

Format: Binary

-

HEX: 00

-

File types that use the extension .ATM:

Vue Atmospheres File

PSP Game Audio File