- What Are Common Causes of .TAX2009 Files Lost or Failure?

- How to recover lost .TAX2009 files?

- Programs to recover .TAX2009 files

- How to open file with .TAX2009 extension?

What Are Common Causes of ".TAX2009" Files Lost or Failure?

There are several common causes of ".TAX2009" files being lost or experiencing failure:

- Accidental deletion: Users may accidentally delete the ".TAX2009" files while organizing or cleaning up their computer systems.

- Software or hardware issues: Malfunctioning software or hardware can lead to the corruption or loss of ".TAX2009" files. This can occur due to system crashes, power outages, or other technical problems.

- Virus or malware attacks: If a computer system is infected with a virus or malware, it can potentially damage or delete ".TAX2009" files.

- File system errors: File system errors can occur due to improper shutdowns, disk errors, or other issues, leading to the loss or corruption of ".TAX2009" files.

- Incompatible software or updates: If the software used to open or manage ".TAX2009" files is not compatible with the operating system or other software updates, it can cause errors or loss of data.

- Human error: Mistakes made by users, such as accidentally overwriting or saving changes to ".TAX2009" files, can result in data loss.

- Physical damage: Physical damage to the storage device where the ".TAX2009" files are stored, such as a hard drive failure or damage to external storage devices, can lead to data loss.

It is important to regularly back up ".TAX2009" files to prevent data loss and consider using data recovery tools or services if files are lost or corrupted.

How to recover lost ".TAX2009" files?

Sometimes while working with a computer, laptop or other stationary or mobile devices, you may encounter various bugs, freezes, hardware or software failures, even in spite of regular updates and junk cleaning. As a result, an important ".TAX2009" file may be deleted.

🧺 How to Recover Files and Folders After Sending Them to the Recycle Bin and Deleting? (Windows 11)

By no means should you think that the only way to recover a ".TAX2009" file is always to create it once more.

Use programs for recovering ".TAX2009" files if a file was lost after accidental or deliberate deleting, formatting the memory card or the internal storage, cleaning the storage device, after a virus attack or a system failure.

Programs to recover ".TAX2009" files

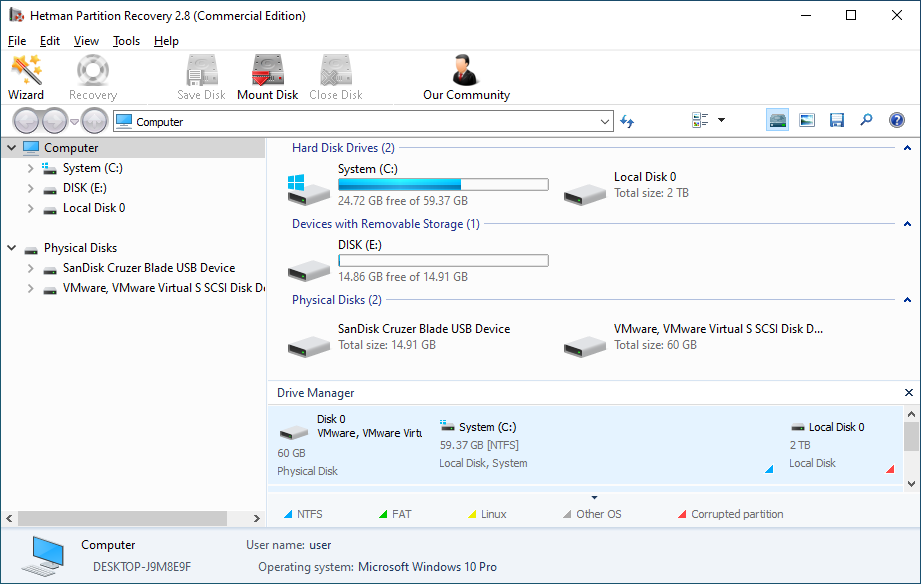

Looking for a way to get files back? In cases when files were deleted and they cannot be restored by using standard operating system tools, use Hetman Partition Recovery.

Follow the directions below:

-

Download Hetman Partition Recovery, install and start the program.

-

The program will automatically scan the computer and display all hard disks and removable drives connected to it, as well as physical and local disks.

-

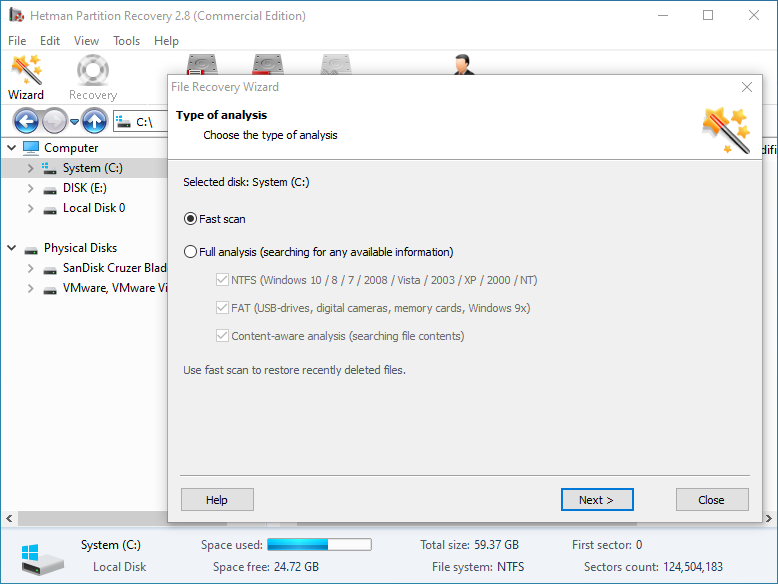

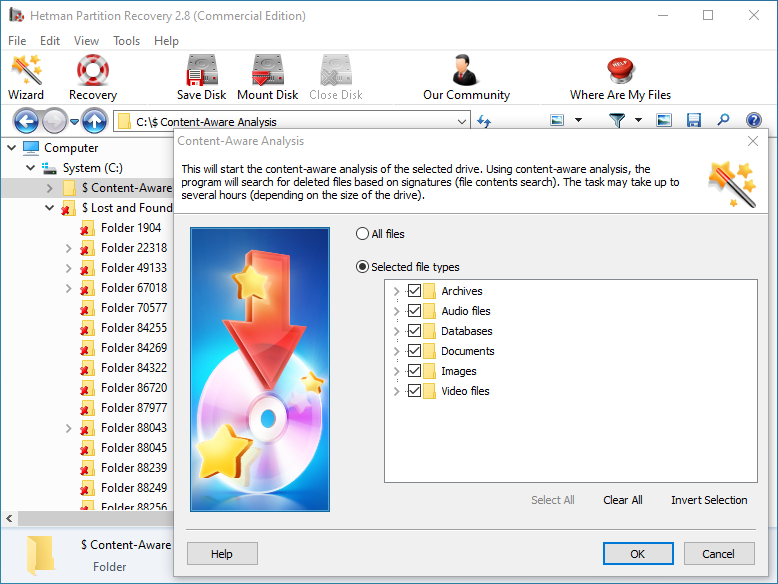

Double-click on the disk from which you need to recover ".TAX2009" files, and select analysis type.

-

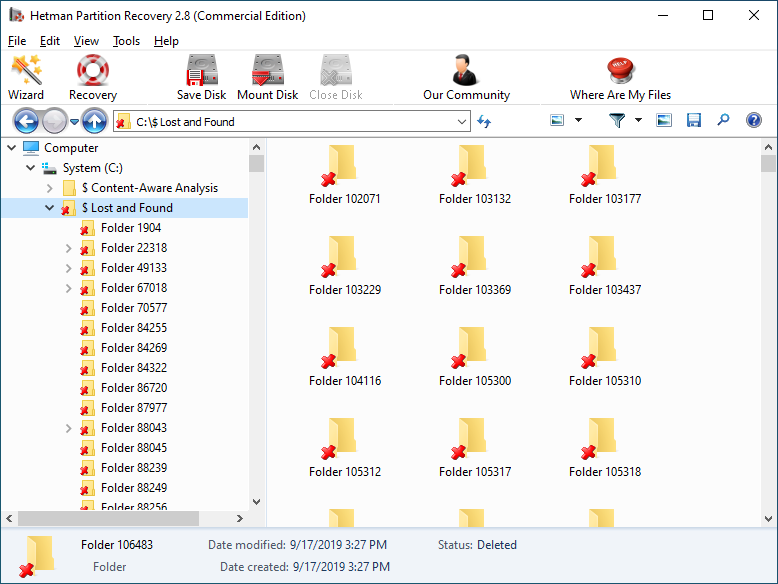

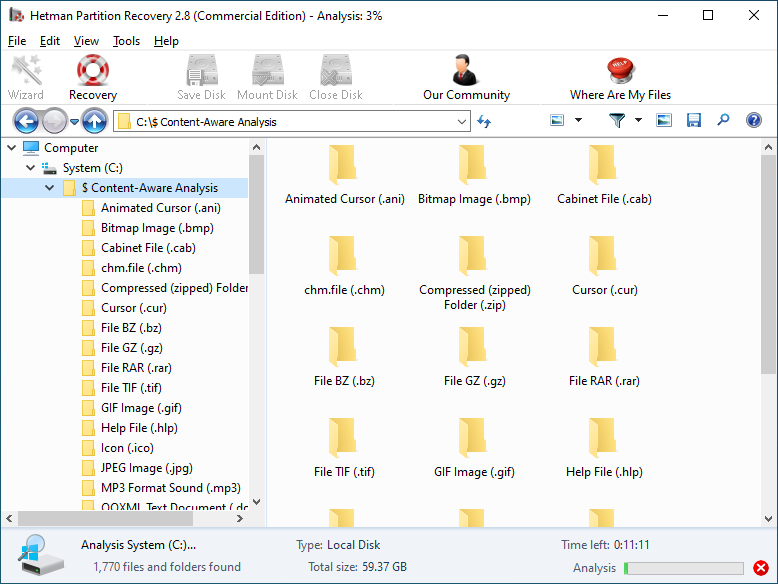

When the scanning is over, you will be shown the files for recovery.

-

To find a file you need, use the program’s interface to open the folder it was deleted from, or go to the folder "Content-Aware Analysis" and select the required file type.

-

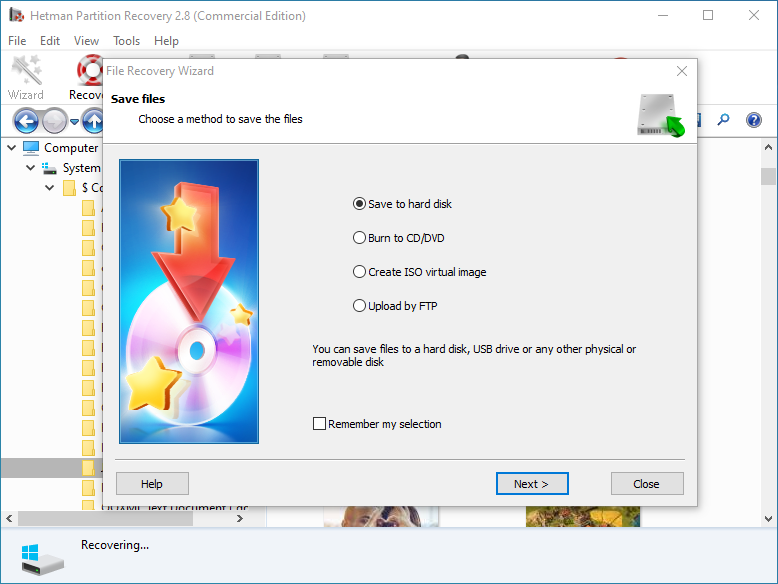

Select the files you have been looking for and click "Recovery".

-

Choose one of the methods for saving the files and recover them.

How to open file with ".TAX2009" extension?

Looking for how to open a stereo turboTax 2009 Tax Return image file file?

Programs that open ".TAX2009" files

| Windows |

|---|

|

|

| Mac |

|

|

Additional Information

-

File type: TurboTax 2009 Tax Return

-

File extension: .TAX2009

-

Developer: Intuit

-

Category: Data Files

-

Format: Binary